Bai Bithman Ajil (sometime spelt as Bay' Bithaman Ajil) or BBA, is an Islamic financing product involving sale of goods where the sale price is payable on instalment basis. This type of transaction is best referred to as "deferred payment sale". However, in layman term, it's just a purchase of good on credit.

Under conventional banking perspective, banks do not engage in the business of selling goods but grant loans repayable by monthly instalment (or depending on the facility type, repayment can also be on demand basis) where interest (in Islam, interest chargeable by Banks is also considered as usury or riba) is charged until the principal portion (or the original loan amount) is fully repaid.

As mentioned many times in this blog, usury (or interest) is strictly prohibited in Islam. This claim is clearly evidenced by Al Quran verse Al Baqarah (2:275) below:

Extract from website Noble Quran

The keywords of surah Al-Baqarah 275 is that "Trade is like usury but Allah had permitted trade and forbidden usury". Thus, instead of offering the joint venture financing product of Musyarakah (known as Shariah base product which is contrary to Shariah compliant product) during the inception of the first Islamic Bank i.e. Bank Islam Malaysia Bhd (BIMB) in Malaysia in 1983, the Islamic financing product of Murabahah was introduced to meet the above Quranic verse interpretation. Before we define what is "Murabahah" it should be noted that BBA is a Murabahah product but the product name of BBA was given by BBMB to differentiate between a short term (below 12 months) and long-term (above 12 months) tenor financing products.

Now, what is Murabahah?

Murabahah or murabaha (Arabic مرابحة, more accurately transliterated as murābahah) involves a sale where the seller indicate his original cost of purchasing the good/s (in banking perspective - the original financing amount offered by the Bank) and the mark-up amount (agreed profit rate (%) x financing tenor) as the selling price. In most cases, the buyer would have pay certain amount as deposit (normally 5 - 10% of purchase price) while the balance is payable on instalment basis over the agreed deferred payment period (financing tenor) using the bank financing facility.

If we are to analyze the transaction flow, it is a "trade" transaction (Shariah compliant) but if we are to really view the transaction based on Shariah based interpretation, (explained under Section 30 of this blog) we need to evaluate validity of the transaction based on these requirements:-

ISSUE NO.1

i) is it a REAL trade transaction? What is the real intention of the transaction?

ii) was it a pre-arrange sale to validate the "trade" transaction so as to meet the requirement of Surah Al-Baqarah (2:275) i.e. irrespective it is a bi-lateral or tri-partied transaction; and

iii) why there is issue of "time value on money?" i.e. why sale price differs from one deferred payment period to another, for example the sale price for purchase under deferred payment sale of say, one (1) year is different from say, ten (10) years?.

We shall discuss all Shariah related issues (will be numbered accordingly as above) when readers have fully understood basic modus operandi (or transaction flow according to most common prevailing banking practises in Malaysia) of Murabahah/BBA. We shall examine all the issues based on practitioners' point of views versus opinion of Islamic scholars who are in favour and those who are against the princple of "deferred payment contract" product. We are not trying to create confusion among the readers of this blog but seeking consensus among the scholars (who mostly does not have banking experience) but raise issues on validity of product.

Irrespective the above-mentioned issues, conceptually, Murabahah/BBA involves the followings:

• Based on BUYING and SELLING concepts where all these five (5) tenets must be available:

i. Seller/Vendor

ii. Buyer/Purchaser

iii. Goods/Assets

iv. Price/Consideration

v. Akad/Contract (Offer & Acceptance)

The contract of buying & selling is established upon full completion of all 5 tenets above.

• Sell at FIXED price (principal amount plus fixed profit margin i.e. for whole financing tenor);

• Bank’s PROFIT MARGIN is based on BUYING and SELLING; NOT from money LENT out as loans;

• Sale price is the CEILING AMOUNT (the Writer opine that BBA can be considered a hedge product since its sale price is fixed throughout the financing period vis-a-vis a variable conventional interest rate environment ) that the bank can claim or amount due from the buyer (or customer);

• Goods delivered upfront and must be also be free from all encumbrances (seller has valid title or ownership over the goods)

• Financing tenor can be from short, medium to long term basis.

The Bai Bithaman Ajil/Murabahah facility can be graphically explained according to the following chart :

Chart 1

The property purchase transaction has to undergo the normal legal documentation prior release of the funds to the developer/vendor but in short, the transaction flow (acceptable in Malaysia) process based on the above graphical chart is as follows:-

1. Buyer (customer) identified an asset to be sold by a vendor, where the asset can be either:

- a property under construction (where bank will release the amount financed progressively according to architect's claims), or

- a completed house (e.g. house for sale by first owner);

i). Are we using the right contract or Islamic principle? i.e. BBA to purchase house under construction? Some scholars said that the Banks should be selling tangible asset instead of selling "a non existence asset" since the house is yet to be constructed;

ii). Should the right contract for house under contruction be "istis'na or Sale by Order?"

2. Buyer will sign the Sale & Purchase (S&P) Agreement with the developer/vendor and pay certain agreed down-payment (or just a booking fee first) to indicate Buyer's commitment to purchase the house;

3. Buyer cannot afford to pay cash for the purchase thus, Buyer will approach an Islamic Bank to finance the purchase;

4. Based on the Buyer's S&P Agreement with developer/vendor, Bank will sign a Novation Agreement (some banks, discard this practice) and the Property Purchase Agreement (PPA) with the Buyer. When the Bank signed the PPA, the Bank become the beneficiary owner of the house;

5. Upon completion of the normal legal requirement processes, the Bank will pay the vendor in full (or progressively) to complete the sale transaction. Prior releasing the funds, the Bank will sign the Property Sale Agreement (PSA) with the Customer indicating that it has sold the property to the Customer.

6. The Customer will pay the deferred installment amount on monthly basis until full settlement.

POINT TO NOTE

i. Murabaha/BBA is a Shariah CONTRACT/MODE OF PAYMENT. If the transaction is on bi-lateral basis (involves only 2 party), then the contract is known as Bai Al-Inah.

ii. The buying and selling transaction between the Bank and customer does not involve legal transfer of ownership. However under Shariah (Malaysian view), the buy and sell transaction is considered genuine sale where the rights over the property is transferred although on paper the house is not registered in Bank's name;

iii. Real Property Gain Tax (RPGT) that should have been derived from the buy and sell transaction (if any), is exempted.

iv. The principal financing document is Asset Sale Agreement.

v. Stamping is on “ad valorem” basis (RM5 per RM1,000 financing amount) but on the Bank’s Purchase Price (Amount Financed).

vi. The underlying asset for transaction not necessary be charged as Collateral since collateral is considered administrative matter. However in practice, the owner's name will be registered as the owner in the land office registry while the Bank will have a charge over the property;

vii. Stamp duties for re-financing from conventional to Islamic, is exempted. Facility in excess of original financing amount, stamp duties chargeable only on additional amount. Will also enjoy 20% stamp duty remission for new facility (this remission may be one day be retracted by the Government to ensure level playing field with the conventional bank);

Before we close this section, the Writer would like to show other verses in the Quran ( Surah Al-Baqarah) that explains Muslims must keep away from usury or riba.

Surah Al Baqarah (2:276) - Allah deprive usury from ALL BLESSING.

Surah Al Baqarah (2:276) - Allah deprive usury from ALL BLESSING.

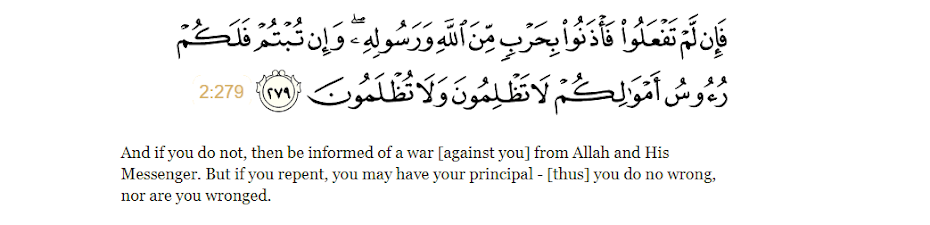

Surah Al Baqarah (2:278) and (2:279). More importantly is surah 279 since Allah and the prophet declares WAR to those who deal in usury or riba.

Allah knows best.