As a guide, the following topics will be discussed. Although some of the topics are a bit technical, we shall try to explain and express the same with simple examples.

1.0 INTRODUCTION

Why Islamic Banking?

Islamic Banking in Malaysia

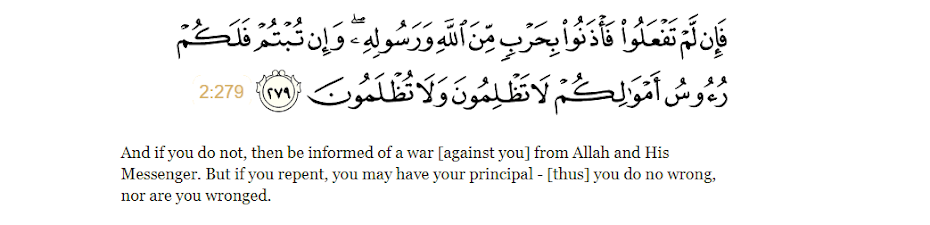

Doctrine of Usury (Riba)

Usury - Historical Overview

Sources of Syariah Law

Syariah Requirement & Prohibitions

Essential Elements and Necessary Conditions in Contract

Types of securities allowed under Syariah Law

Why the need of separate Banking System for Muslim?

Common questions raised by those who do not understand Islamic Banking!

Is Islamic Banking for Muslim Only?

Syariah Qualification (how to determine whether a company is doing “halal” business)

2.0 SOURCE OF FUNDS

Shareholders’ Equity

Customers Deposits (detailed comparison between conventional and Islamic account deposits, inclusive brief outline on deposits offered by commercial banks)

Al-Wadiah savings

Al-Mudharabah – General Investment Account

Al-Mudharabah – Specific Investment Account

How Islamic banks fund its operation via Islamic Interbank Money Market (IIMM)

IIMM mechanism and types of IIMM products

3.0 APPLICATION OF FUNDS

(Types of financing facilities – comparative approach between conventional & Islamic banking and practical application)

Murabahah/Al-Bai Bithaman Ajil/Commodity Murabahah (Tawarruq transaction?)

Cash line facility (Overdraft)

Al-Murabahah (inclusive revolving credit/Vehicle Floor Stocking)

Al-Mudharabah (Trustee Joint Venture Financing)

Al-Musyarakah (Joint Venture Financing)

Al-Ijarah Thumma Al-Bai' (AITAB-Islamic Hire Purchase)

Al-Kafalah (Bank Guarantee)

Al-Qhardul Hassan (Benevolent loan)

Istisna Ijarah Mawsufah Fi Zimah (Order Sale and Forward Leasing)

Al-Ijarah Muntahiya Bitamlik (Leasing ending with ownership)

Al Rahnu (pawn broking)

Brief overview on Islamic Structured products & Islamic Capital Market (including Islamic REITS)

4.0 HOW IS PROFIT CALCULATED AND SHARED BETWEEN BANK AND CUSTOMERS?

Income recognition method and formula use by Islamic banks;

Understand profit distribution table (common format for profit distribution between Bank and the Customer);

Transfer pricing via inter-branch profit distribution/incentive.

5.0 ISLAMIC BANKING ACCOUNTING

Examples of Accounting entries;

Islamic banking treatment on General Provision (GP)

Islamic banking treatment Non-Performing Accounts (BNM GP3 guidelines)

Loss Write-Off

6.0 OPERATIONS

Price structure e.g. multi-tier profit rate, step-up/step-down profit rate.

Types of progressive disbursement – average method, lump sum and scheduled method.

Reschedule of payment and treatment on partial payments;

7.0 BRIEF OVERVIEW ON ISLAMIC LEGAL DOCUMENTATION

Types of Agreements (market practice)

Common flaws in legal documentation(to detect usual flaws in legal documents drafted by lawyers)

Court Jurisdiction – Shariah or Civil Court

Some past legal cases and legal precedence (focus on Zulkifli Vs Affin Bank)

Special Courts & Tribunal

8.0 WHICH IS CHEAPER & PROFITABLE – COMPARATIVE STUDY BETWEEN CONVENTIONAL AND ISLAMIC BANKING BUSINESS

Consumer point of view! (to prove Islamic Banking facility is cheaper than conventional facility)

BLR trend for last 24 years – fixed versus variable interest rates (as benchmark for Islamic banking pricing?!)

Impact of 1997 currency crisis in banking industry i.e. on conventional and Islamic banking system and customers.

Bankers point of view (to prove some of the Islamic Banking products are more profitable than conventional banking products although technically cheaper???)

Effective Return comparison between Islamic and conventional banking

9.0 CHALLENGES

Challenges, Future direction and industry trend

Past Performance & Industry Statistics on Islamic banking.

10. TRUE ISLAMIC BANKING

What are the true Islamic banking products? The writer point of view

Why Muslim scholars continue arguing this and that product is non-Islamic or more Islamic?

Why are we moving backward i.e. trying to emulate conventional products like derivatives and name the product as Islamic derivative?

Other topics that the writer will examine are Takaful and Capital Market Product (including sukuk, structured products).

Please take note that some of the topics that will be discussed above, may not be the general view of Islamic bankers, regulators or even Islamic banking scholars. In addition, the writer may also write his own view based on the writer's own experience on the operation and practical aspects of the Islamic banking business.

IslamicBankingWay.Com

ALLAH KNOWS BEST

Assalamu alaikum and good day to all visitors of this blog. Effective today (25th July 2009), I will be writing from time to time on the Islamic banking practises in Malaysia. My purpose for setting this blog is to share my Islamic banking knowledge and experiences to create awareness on Islamic banking practises to internet users throughout the world. Appreciate if you can share this blog address with others.

Wednesday, September 23, 2009

Wednesday, September 16, 2009

3-Buy and sell transaction

Salaam, before we go into Islamic banking concept proper, I would like to remind all visitors on various wrong terminologies or choice of words used by the media, writers, some Islamic scholars and also some Islamic bankers (especially those with conventional background and just joined Islamic banks). To ensure everything to do with Islamic banking is shariah compliant, we must ensure correct terminologies and words are used to avoid gharar' (ambiguity). Let's examine the various terminologies commonly used now in describing Islamic banking products:-

Buy and Sell transaction

Buy and Sell transaction

- Islamic banking loan - financing concept which are sale related (under contract of buy and sell) like Murabahah (deferred payment sale) or Al-Bai Bithaman Ajil (actually murabahah but was given special product name by Bank Islam to denote deferred payment sale facility with payment tenor of above 12 months), Al-Mua'jjal (or any other names given by Islamic banks) is NOT A LOAN. The only Islamic loan product available is Al-Qhadhul Hassan or benevolent loan which is 100% profit free. If bank grant a customer a RM100,000 loan payable over say, 1 year, the maximum amount that the customer need to pay-back to the bank is RM100,000. "Trade is like riba but Allah permitted trade and prohibited riba". Thus, due to the fine line between trade and riba, the correct word to describe Islamic banking sale contract such as Murabahah should be "financing or pembiayaan" instead of "loan or pinjaman";

- The word "borrower" which is meant for an Al-Qhadhul Hassan borrower, should be termed as "customer" under a sale transaction. When the word borrower is used, technically it means someone that need to repay a loan and since Murabahah is not a loan but a sale contract, customer is the right word to describe the transactors i.e. seller (the bank) and customer (buyer).

- Term like "repayment" means, to repay a loan. To avoid gharar', the best choice of word should be "payment" for example, "payment of monthly installment" or "payment of sale price".

- The word "interest" is also commonly used?! In a sale transaction, one need to sell higher than the original purchase price to make profit. Without profit, nobody in this right mind would engage in business transaction. Likewise, when a bank purchase a property (with intention to resell at a profit) at RM100,000 and sold it for RM120,000 to the customer (buyer), it means the Bank makes profit of RM20,000. Under the contract of buy and sell, the sale price is the ceiling price that the customer will pay or the bank will charge! This mean, if the customer defaults, the maximum amount that the bank can claim from the customer is only RM120,000. Under conventional bank, the bank shall continue to charge interest on compounding basis i.e. interest upon interest, until the loan is repaid. However, in reality, to avoid customers taking advantage on Islamic banks, National Shariah Advisory Council of Bank Negara Malaysia (BNM-NSAC) allowed Islamic banks do charge compensation charges (or penalty fee) on late payment but whatever compensation charges collected by the bank, are normally given to charitable organisation. Compensation charges should not be a source of income to the bank but as an attempt by the Bank to avoid customer from delaying payment. It is interesting to note that Banks in South Korea charge penalty interest at 12% per annum (much higher than the normal lending rate of between 6-8% per annum) to ensure borrowers pay promptly. If we examine this practise, in Korea paying promptly is cheaper than delaying payment. To think about it, it is good if this system can be implemented in Malaysia to avoid overdue payments.

- Another term wrongly used is "repayable on demand or to recall the facility". This term is commonly use by Islamic banks to take action on defauting customers i.e. to recall the loan. Islamic Bank cannot use similar term for a deferred payment sale contract. To avoid gharar', the correct term that the bank should use is, for example, "the bank reserve the rights to accelerate the monthly installments or accelerate the payment of the sale price" instead of recalling the facility.

We'll learn more about the proper terminology to be used for other products as we engage the various Islamic banking topics in this blog.

IslamicBankingWay.Com

ALLAH KNOWS BEST

Labels:

Buy and Sell transaction

Subscribe to:

Posts (Atom)