Assalamu alaikum and good day

For those who have been following Islamicbankway twitter, the Writer did mentioned that he has decided to write about Islamic financing product hereon instead of Treasury products due to numerous emails that he received asking to focus on the financing product. So, not to disappoint such requests, effective immediately, the Writer shall focus on Islamic financing first.

Before writing about the financing concept in Islamic Finance, the Writer would like remind all Readers about the frequent wrong terminologies or choice of words used by the media, writers, some Islamic scholars and also some Islamic bankers (especially those from conventional banking background and just joined Islamic banks). The Writer has written on this issue under Session 3 of this blog in 2009 but before we move on to discuss the various Islamic financing products available in the market today, the Writer would like to recap what was deliberated in Session 3.

Correct choice of words must be used to ensure the Islamic finance transactions are not only Shariah compliant but also comply the basic rules under fiqh muamalat and in addition, all ambiguities (gharar' ) must be avoided.

One important factor that we need to know is the difference between Shariah Compliant and Shariah Based financing products. When we say Shariah Compliant financing products, most of the financing products are offered or originated from conventional banks such as bond, structured products, term loan etc but the transactions flows of the products are structured to meet Shariah rules, for example, using 'buy' and 'sell' to validate (requirement under Quranic Al-Baqarah 275) the financing product of Al-Bai Bithaman Ajil (Murabahah). Most Shariah scholars are of the opinion that such transactions are permissible but of course, there are also scholars who do not agree with the structure and said such transactions as disguised usury ('riba').

On the other hand, Shariah based products are said to be approved by Prophet Muhammad S.A.W. (PBUP) and used by traders during the Prophet's time. Examples of these products are Qard (benevolent loan), Musyarakah (equity joint venture), Mudharabah (trustee profit sharing) and Ijarah (leasing).

Important element to distinguish between Shariah based and Shariah compliant financial products is for example, under lease financing, the lessor must be a true (real) owner of the asset or when it involves a sale transaction under murabahah, the sale is a 'true sale' and not a sale to validate a transaction such as using Commodity Murabahah where oil palm or metal is used as the underlying asset to validate the 'buy and sell' requirement. Quite often, commodity murabahah is used to validate ' unsecured' term financing facility offered to customer.

Now, let's recap some of the choice of words that should be used when we talk about Islamic finance products:-

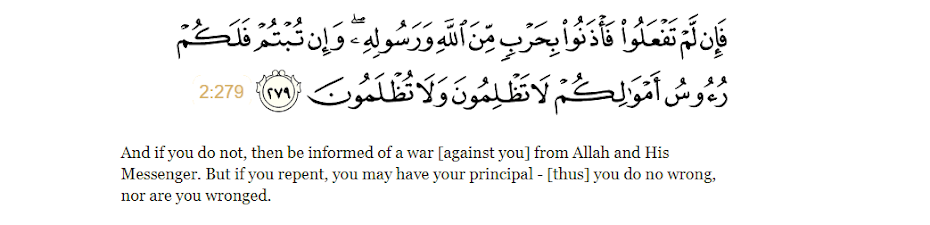

1. Islamic loan - financing concept which are sale related (under contract of buy and sell) like Murabahah (deferred payment sale) or Al-Bai Bithaman Ajil (actually a murabahah product but was given special product name by Bank Islam to denote deferred payment sale facility with shorter financing tenor e..g not exceeding 12 months), Al-Mua'jjal (or any other names given by Islamic banks) is NOT A LOAN. The only Islamic loan product available is Al-Qard or benevolent loan which is 100% profit (interest) free. What it means here, under Qard financing facility, when a Bank grant a customer a RM100,000 loan payable over say, 1 year, the maximum amount that the customer need to pay-back to the bank is RM100,000 (only the principal amount). "Trade is like riba but Allah permitted trade and prohibited riba". Thus, due to the fine line between trade and riba, the correct word to describe Islamic banking sale contract such as Murabahah should be "financing or pembiayaan" instead of the "loan or pinjaman";

2. The word "borrower" which actually meant for Qard borrower, should be termed as "customer" under a sale transaction. When the word borrower is used, technically it means someone who need to repay a loan. Since Murabahah is not a loan but a sale contract, the term "Customer" should be the right word to describe the transactors i.e. seller (the bank) and customer (buyer).

3. Term like "repayment" means, to repay a loan. To avoid gharar', the best choice of word should be "payment" for example, "payment of monthly installment" or "payment of sale price". Surprisingly, I have seen Islamic bank using words such as "longer repayment period" in the personal financing brochure.

4. The word "interest" instead of 'profit' is also commonly used?! In a sale transaction, the Bank need to sell higher than the original purchase price to make profit. Without profit, no nobody in his right mind would want to engage in trading business. Likewise, when a bank purchase a property (with intention to resell for a profit) at RM100,000 and then sold it for RM120,000 to the customer (buyer), it means the Bank makes profit of RM20,000 upon full settlement of the sale price. Under the contract of buy and sell, the sale price is the CEILING PRICE that the customer will pay or the bank will charge!

This means, if the customer defaults, the maximum amount that the bank can claim from the customer is only RM120,000 (one of the important advantage in Islamic financing product). Under conventional bank, the bank shall continue to charge interest on compounding basis i.e. interest upon interest, until the loan is repaid.

However, in reality, to avoid customers from taking advantage on Islamic banks, National Shariah Advisory Council of Bank Negara Malaysia (BNM-NSAC) has allowed Islamic banks do charge compensation charges (akin to penalty fee) on late payment but whatever compensation charges collected by the bank, are normally given to charitable organisations. In this respect, compensation charges should not be a source of income to the Islamic bank but as a deterrent mechanism to avoid customers taking advantage on the Islamic banking system by delaying their instalment payment to the bank. It is interesting to note that banks in South Korea charge penalty interest at 12% per annum (much higher than the normal lending rate of between 6-8% per annum) to ensure borrowers pay promptly. If we are to examine their rationale, it would be cheaper to pay promptly rather than delaying payment.

5. Another term wrongly used is "to recall the facility". This term is commonly use by Islamic banks to take action on defaulting customers i.e. to demand full payment of the facility. To avoid gharar', the correct term that the bank should use is "the bank reserve the rights to accelerate the monthly installments or accelerate the payment of the sale price" instead of recalling the facility.

The wrong terminologies used by Islamic bank may not be a concern now but we never know one day where recovery of default Islamic account has to go through the Shariah court, the wrong choice of words may render the sale transaction as non-Shariah compliant. In such situation, the customer may end up just paying the principal amount WITHOUT any profits.

With the recent revision of Shariah Governance Framework where banks are required to ensure they have qualified people in Shariah risk management, Shariah audit, Shariah Review and Shariah research and advisory, we can see that Bank Negara is starting get tough with the Islamic Banks to ensure all transactions are truly Shariah compliant. Sad to say, from Writer's own experience, Islamic products are usually compliant on paper but quite often, product can be classified as Shariah non-compliant due to failure in its operational side, such as these three (3) examples (there are actually more):

a) signing sale legal document first instead of signing purchase legal document (to reflect we need to purchase first before selling it) under Al-Bai Bithaman Ajil transaction;

b) Using conventional accounting entries i.e. the accounting entries only show sale transaction but there are no entries to show the purchases;

c) More serious error still being practise by an Islamic Bank is "compounding of profit" akin to conventional bank "interest upon interest" calculation for overdue installment. This happen when the Islamic bank staff of an Islamic subsidiary or Islamic window do not take ownership of the " Islamic system specifications" and left it to the conventional bank's IT staff, when leveraging on the conventional bank IT system instead of having its own seperate system;

We shall learn more about the proper terminology to be used for other products as we engage the various Islamic banking topics in this blog.

IslamicBankingWay.Com

ALLAH KNOWS BEST